How Citrin Cooperman Can Help

With the increase in the regulation and taxation of private equity, hedge funds, and other investment vehicles participants in the private equity arena may raise their compliance costs, reduce their returns, and limit the number of investment activities companies can undertake. Industry regulation is expected to continue to increase. Also under the Trump administration, a greater number of private equity firms are viewing the investment environment as favorable. In addition, fund managers are looking towards IPOs as the most profitable exit strategy.

We’ve also noted several challenges that may affect investors in the industry:

- While investor sentiment towards private equity is positive, there remain a number of challenges facing investors in this asset class. High valuations for portfolio companies remain the number one concern. Combined with record levels of dry powder and stiff competition for assets, investors are increasingly concerned about the impact high pricing will have on returns in future.

- With valuations high, the exit environment has also become a key issue for the industry, with investors concerned that it may become more difficult for fund managers to realize their investments at current valuations.

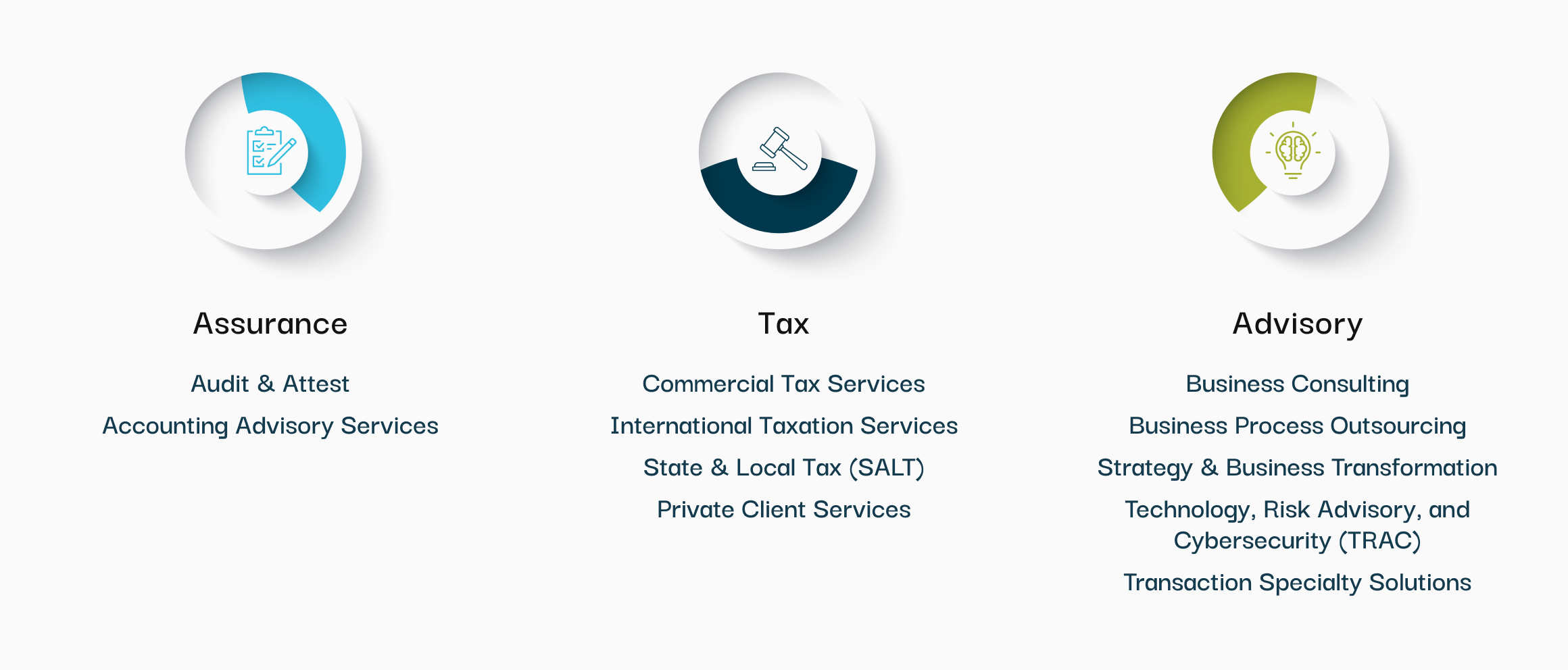

Citrin Cooperman’s Private Equity and Capital Markets Practice is comprised of highly experienced professionals who provide valuable insight and knowledge to help our clients navigate the complexities of a new administration and today’s global market, while driving the growth of their portfolios and funds. We advise private equity funds, portfolio companies, venture capital and buyout firms throughout the entire fund cycle. Our professionals work to steer all aspects of fund services, transaction advisory services, and portfolio management and compliance through a comprehensive suite of attest, tax, structuring, compliance, valuation, and business advisory services.

Specialty Services

Citrin Cooperman’s dedicated team includes senior practitioners with extensive experience with Securities and Exchange Commission (SEC) client matters, and we support our clients’ transactions through a diverse suite of services. We have the technical skills, industry knowledge, and insight to make critical decisions and add value at a moment’s notice. This includes advising on preparing for becoming a listed company, advising on business restructuring, accounting and regulatory issues, and acting as reporting accountants. Our services include:

Deals

- Buy-side and sell-side due diligence

- Quality of earnings report

- Tax planning and structuring

- Valuation services

- Integration consulting

- Special purpose acquisition company (SPACs) transactions

Portfolio Companies

- IPO readiness

- Audit

- Tax compliance

- Tax consulting

Private Equity Funds

- Auditing, financial, and reporting Administration

- Tax compliance

- Tax consulting

- Regulation Valuation

Private Equity Leaders

View All SpecialistsPrivate Equity Insights & Resources

All InsightsSign up for Private Equity insights.

Our in-focus thought capital resource center provides insights on real-time, relevant, strategic and tactical business issues and trends to help keep you in front of what's happening in your industry and the market.

Our Private Equity Specialists are here to help.

Get in touch with a specialist in your industry today.