Debt-Financed Taxpayers Might Not Be Able to Deduct All Interest in 2022

The Tax Cuts and Jobs Act (TCJA) enacted in 2017 significantly changed the limitation on the deduction for business interest expense for certain taxpayers. This modification is referred to as the “Section 163(j) limitation.” For tax years beginning January 1, 2018, Section 163(j) applies to all businesses, except taxpayers that are deemed “small business” and specific trades or businesses that are eligible but have opted to elect out. The small business exception applies to businesses whose average annual gross receipts equal to less than $27 million (applying controlled group rules for affiliated entities). Certain real property trades or businesses were able to elect out of Section 163(j) but were required to use the alternative deprecation system (ADS) for qualified improvement property and rental property.

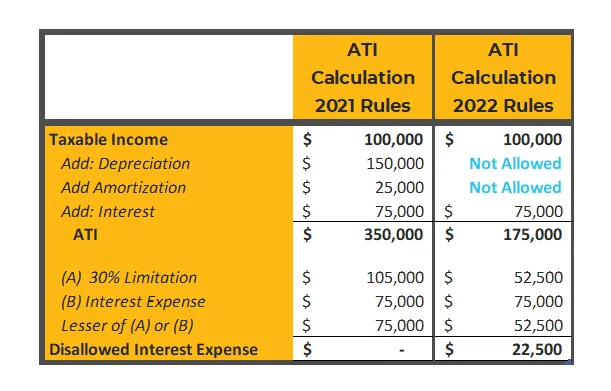

If you were not able to meet the small business exemption and you are not a real property trade or business, your business interest expense may have been limited. In order to determine the limitation, your business will need to compute the adjusted taxable income (ATI) using Form 8990. It is important to note that as other businesses were computing their ATI, the biggest adjustment benefiting their limitation was the addback of depreciation and amortization. This adjustment was increasing their ATI and in turn decreasing the amount of interest to be limited.

However, beginning in 2022, the IRC Sec. 163(j) interest limitation will no longer include the modification addback of depreciation and amortization. This will lower most taxpayers’ ATI, and likely subjecting more interest expense to the 163(j) limitation.

An overly-simplified interest expense limitation can be illustrated as follows:

Leveraged businesses should project their 2022 tax posture to determine whether or not they will have their interest expense deductions limited. If their interest expense deduction is limited, they can consider reamortizing their debt, or finding other ways to increase their ATI without increasing their taxable income. Please contact Paul LiRosi at plirosi@citrincooperman.com or Michael Cianciaruso at mcianciaruso@citrincooperman.com if you have any questions.