April 30, 2025 - Financial planning and analysis (FP&A) is undergoing a fundamental shift fueled by the rise of hyperautomation. This advanced approach integrates artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and advanced analytics to create an intelligent, self-optimizing financial ecosystem. By eliminating manual inefficiencies and enhancing predictive capabilities, hyperautomation redefines how organizations approach budgeting, forecasting, and financial decision-making.

As businesses face mounting pressure to improve accuracy, speed, and agility in financial operations, adopting hyperautomation is no longer a competitive advantage — it's a necessity. Hyperautomation enables finance teams to shift from labor-intensive, spreadsheet-driven tasks to high-value strategic analysis, empowering leaders with real-time insights and scenario modeling capabilities.

This article explores the role of hyperautomation in FP&A, highlighting the key benefits, core technologies, and implementation strategies that drive efficiency and innovation. By embracing hyperautomation, organizations can streamline financial processes, enhance decision-making, mitigate risks, and position themselves for long-term success in an increasingly data-driven world.

What Hyperautomation Means for FP&A Teams

Buzzwords like hyperautomation sound impressive — but what do they actually mean in the context of FP&A?

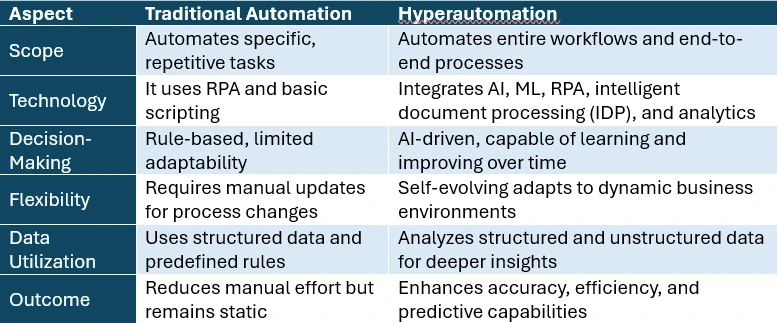

Unlike traditional automation, which focuses on rule-based tasks, hyperautomation creates an intelligent, self-evolving system that continuously improves operations across business functions, including FP&A.

Below are key differences between hyperautomation and traditional automation and what they mean for your finance team.

Traditional automation focuses on predefined tasks and static workflows. In contrast, hyperautomation creates an intelligent, adaptive ecosystem that allows organizations to automate complex processes, predict financial outcomes, and improve decision-making across the board.

In the context of FP&A, hyperautomation goes far beyond basic data entry. It enables dynamic financial modeling, real-time variance analysis, and AI-driven scenario planning, helping finance teams respond faster and more strategically to changing business conditions.

Here is a closer look at the core technologies powering hyperautomation and how they work together to transform financial planning and analysis:

Robotic Process Automation (RPA)

Robotic process automation (RPA) uses software bots to automate repetitive, rule-based tasks traditionally performed by humans. These bots interact with digital systems much like a person would, efficiently handling processes such as data entry, invoice processing, and report generation. In the FP&A space, RPA helps consolidate and reconcile data, accelerate reporting and variance analysis, and simplify compliance and audit tasks — all while reducing manual effort and minimizing errors. This allows finance teams to focus more on strategic analysis and decision-making.

Artificial Intelligence (AI) and Machine Learning (ML)

Artificial intelligence (AI) and machine learning (ML) are central to driving hyperautomation in FP&A. Unlike traditional rule-based automation, these technologies enable systems to learn, adapt, and make strategic decisions in real time. When combined with robotic process automation (RPA), intelligent data processing (IDP), and advanced analytics, AI and ML help transform FP&A into a predictive, agile, and highly automated function.

Through tools like IDP, AI and ML can automatically extract, clean, and categorize vast amounts of financial data. These systems detect patterns, flag anomalies, and generate insights that drive smarter decision-making. By analyzing historical data alongside external market variables, machine learning algorithms produce more accurate forecasts and help leaders anticipate trends. This enhanced speed and intelligence also enables finance teams to spot discrepancies between actual and budgeted performance in real time —empowering quicker, more informed course corrections.

Intelligent Data Processing

As noted, IDP’s role in hyperautomation is automating financial data extraction, classification, and processing from various documents. This tool can scan documents and pull relevant data from financial statements, invoices, receipts, contracts, and reports. It can recognize text, numbers, and tables in documents, even in different formats, thereby reducing manual data entry and human errors. This speeds up the data collection and validation process and allows accounting systems to more easily identify discrepancies or areas of concern.

Advanced Analytics and Predictive Forecasting

Advanced analytics refers to using sophisticated tools and techniques — such as AI-driven data mining, predictive modeling, and prescriptive analytics — to uncover patterns, trends, and insights beyond traditional financial reporting.

Advanced analytics allow teams to continuously monitor financial data streams in real time and use what-if analysis to evaluate multiple financial scenarios and their potential impact. Advanced analytics and predictive forecasting are major players in measuring KPIs and tracking performance.

Embracing Hyperautomation for Smarter FP&A

As FP&A teams face an increasingly complex and fast-paced business landscape, hyperautomation presents a powerful opportunity to boost efficiency, accuracy, and strategic insight. By shifting from manual, spreadsheet-driven processes to intelligent, automated systems, finance professionals can focus more on value-added analysis and forward-looking initiatives — instead of repetitive tasks.

Citrin Cooperman’s Digital Services Practice helps businesses unlock the full potential of hyperautomation. Whether you're looking to modernize your financial processes or integrate advanced automation tools, our team provides guidance tailored to your organization's needs using tools like Vena Solutions. Reach out to us to learn more.