February 10, 2025 - Investors are skittish due to the high interest rates that are making it difficult to invest in real estate. This past quarter, the Loan Momentum Index by CBRE rose 4.3%, which suggests the market is growing stronger, but is still 14% lower than the same time in 2023.

The slight rise in lending recently is, in part, because investors have begun to see opportunities to invest in regions like the Southeast and in assets like multifamily.

Three steps to raise real estate capital

If your real estate business is looking to obtain new funding for a project, you may need to adjust your capital stack, exploring new regions and assets to strengthen your financial approach and present attractive opportunities to potential investors.

Download the guide to outsourcing finance and accounting for real estate →

-

Adjust your capital stack

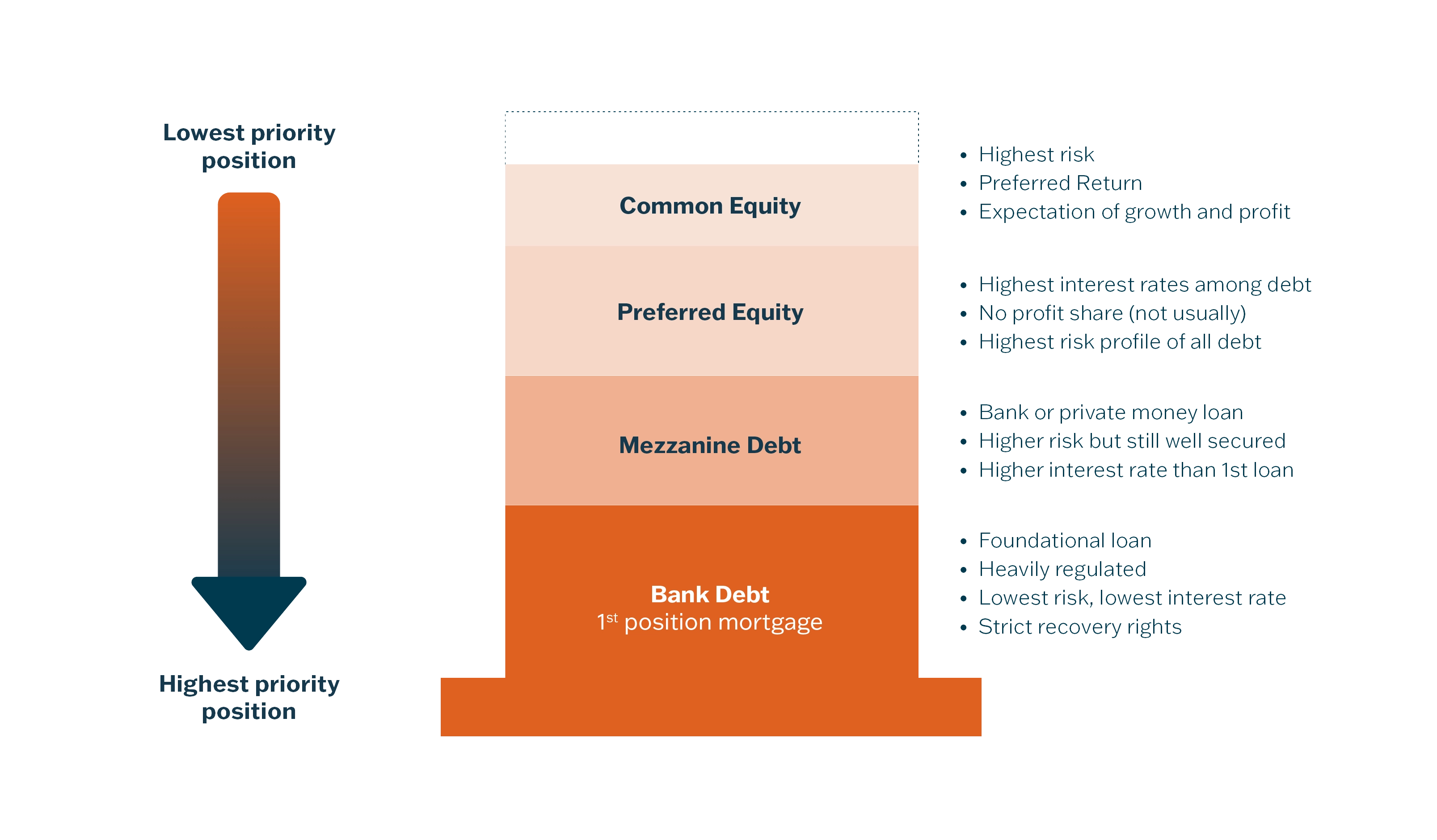

Investors are now seeking alternative financing structures that can provide them with the returns they need without taking on the full risk of an equity investment. They are moving towards debt options like preferred equity and mezzanine debt. A report from Lazard, a financial advisory and asset management firm, showed that preferred equity made up 15% of general partner-led marketing in 2022, an increase from 6% in 2021.

”Preferred equity has become the primary focus of our daily tracking,“ says Laurie Morfin, Senior Managing Director, NewPoint Real Estate Capital. ”Many have ceased traditional purchases, reminiscent of the debt funds from a decade ago.“

Investors want to deploy capital, but they are wary of current market conditions, which is why they find preferred equity and mezzanine debt so attractive at the moment. It is the middle ground between bank debt and common equity and provides a lower risk profile.

[Source: Feldman Equities]

These structures allow investors to participate in the upside of a project while limiting their downside exposure.

What this means for real estate organizations looking to raise more funding is that they will need to restructure their capital stack to include these options.

Note that the restructuring process may require senior-level guidance, especially if in-house teams do not have experience with these financing structures or the time to handle them. An alternative is to outsource finance and accounting to teams with specialized expertise and industry experience to help make the transition.

This is becoming an increasingly popular option as about half of our Private Company Performance Report respondents plan to outsource at least 25% of their needs. Outsourcing reduces the burden on internal teams and ensures there is the guidance necessary to successfully restructure your capital stack. -

Present more attractive opportunities to investors

Investments like office buildings and retail properties are struggling due to a lack of demand caused by remote and hybrid work, and there has been no clear sign of improvement.

As a result, investors are looking for opportunities to fund in other — sometimes niche or emerging — sectors or locations. They believe these sectors will provide better returns in the current market conditions.

”Niche strategies are probably the most interesting place to be looking to acquire assets right now. Some of them have already become mainstream so you no longer need to go through an educational process where you explain the fundamentals of that industry to investors,“ says Shawn Lese, Chief Investment Officer and Head of Funds Management, Americas at Nuveen Real Estate.

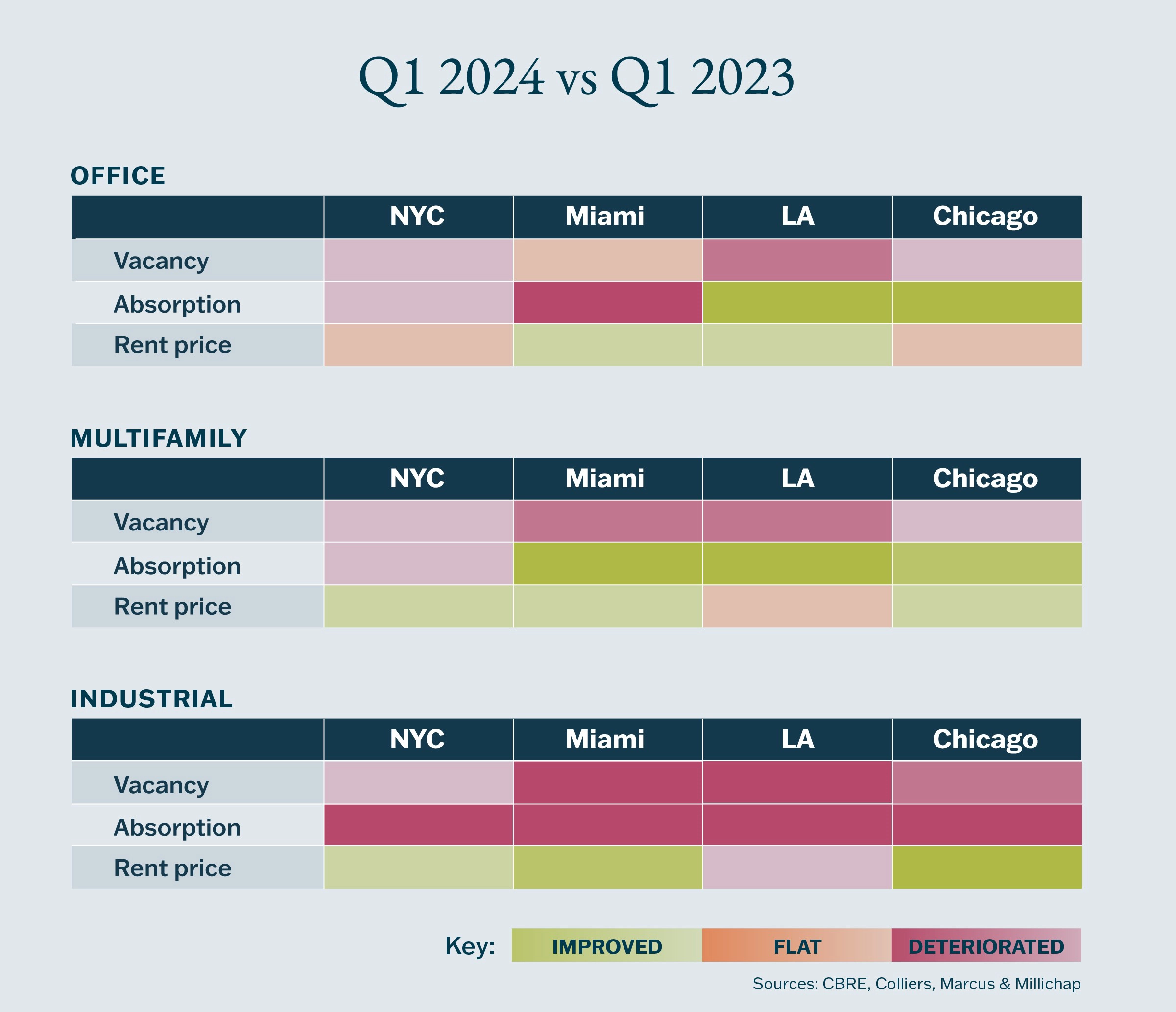

There are many opportunities to be found in different places, like a new high-performing sub-sector or an investment type that is taking off in a new geography. For instance, Miami and Chicago seem to be two attractive locations for multifamily and industrial real estate, which can be observed in a heatmap we shared in our 2024 Real Estate Opportunities Report. Absorption and rent prices have improved in Miami, meaning more people are moving into rental units, signaling strong demand.

Also, according to PERE's United States roundtable participants, data centers, life science spaces, medical offices, new-generation senior living, recreational vehicle parks, and self-storage are all currently appealing.

Keeping up with the latest real estate trends and identifying emerging opportunities is important, but it consumes a lot of resources, which is why the second function real estate firms are planning to outsource is analytics, financial planning, and analysis.

This allows internal teams to focus on other areas of the business while outsourcing providers center their attention on delivering accurate key financial metrics to evaluate these opportunities. -

Use your improved financial approach to make a stronger case with investors

With your restructured capital stack and new investment opportunity, you can now make a more compelling pitch to investors.

As part of your proposal, you will need to prepare detailed financial plans and analyses to show an understanding of the current market situation and trends. You should also be monitoring new developments, like changes to tax laws or zoning regulations, and adjust your strategies accordingly to ensure your plans account for the latest regulatory environment.

In addition, when meeting with investors, you will want to customize your financial projections and models to each conversation. This shows that you have done the work to create an investment thesis that is tailored to their needs.

You can outsource the preparation of the customized financial plans and projections to a specialized finance and accounting team that is able to keep up with new legislation. They have the bandwidth and expertise to handle these tasks, allowing your team to use their time more efficiently and providing confidence that your business will stay in compliance with the current standards and regulations.

Real estate firms are worried about the cost of capital, but outsourcing can help

Our Real Estate Opportunities Report showed that 56% of real estate companies are ”extremely“ or ”moderately“ concerned about the cost of capital. This concern stems from high interest rates and tighter lending standards, which make it difficult to raise more capital.

However, some investors are still deploying capital, especially in the sectors and locations mentioned earlier. Real estate firms just need to tell a better story that highlights how a restructured capital stack and new investment opportunities can provide the upside investors seek while limiting their downside exposure.

It takes a significant amount of time and resources for teams to execute all these tasks correctly while maintaining their regular internal workload. For this reason, outsourcing finance and accounting functions to external providers is an excellent opportunity for real estate organizations.

While outsourcing will not reduce the cost of capital, Citrin Cooperman’s experienced Business Process Outsourcing professionals can help you create an improved capital structure and investment strategy, supported by accurate financial reporting, and better position your firm to obtain funding in this market.

Want to start outsourcing your finance and accounting departments? Please contact Ryan Moore and Deanna Rich to learn more.

Download the guide to outsourcing finance and accounting for real estate →