How Citrin Cooperman Can Help

Citrin Cooperman’s real estate industry practice is comprised of dedicated professionals with expertise in each real estate industry sector and across all lines of service. The depth of experience that our professionals have within the real estate industry allows us to identify risks and challenges to assist our clients in all aspects and stages of their deal’s life cycle. We aim to add value by providing services supporting our clients’ long-term goals and addressing the day-to-day business challenges.

Our real estate clients include:

- Private Real Estate Funds

- Owners/Operators

- Developers

- Real Estate Investment Trusts (REITs)

- Management Companies

- Co-ops and Condos

Our clients’ investments include:

- Residential Assets

- Single-Family

- Multi-Family

- Senior Housing

- Student Housing

- Manufactured Housing/Mobile Home Parks

- Commercial Assets

- Industrial

- Office

- Retail/Shopping Centers

- Self-Storage

- Hotels

- Debt and Preferred Equity Investments

The Journey to a Successful Deal

The journey to a successful deal can be a complex and arduous process. Whether you are structuring your deal, raising capital, managing your portfolio, or liquidating for an exit, Citrin Cooperman’s Real Estate Industry professionals provide curated guidance at every step.

Be sure to follow along over the next several months as we provide content on how to successfully navigate the deal cycle, including nuanced tips from seasoned real estate professionals.

Embracing Change in the Real Estate Industry

In today’s turbulent environment, leaders may be tempted to stick with the approaches that have worked for them in the past – regardless of whether they still fit the purpose – rather than rethinking and changing the way they lead. Our team’s professionals are here to provide innovative, actionable solutions to today’s most pressing issues and help real estate companies refocus, reevaluate, and create effective plans to achieve their strategic vision in the current market. Learn more here.

Specialty Services

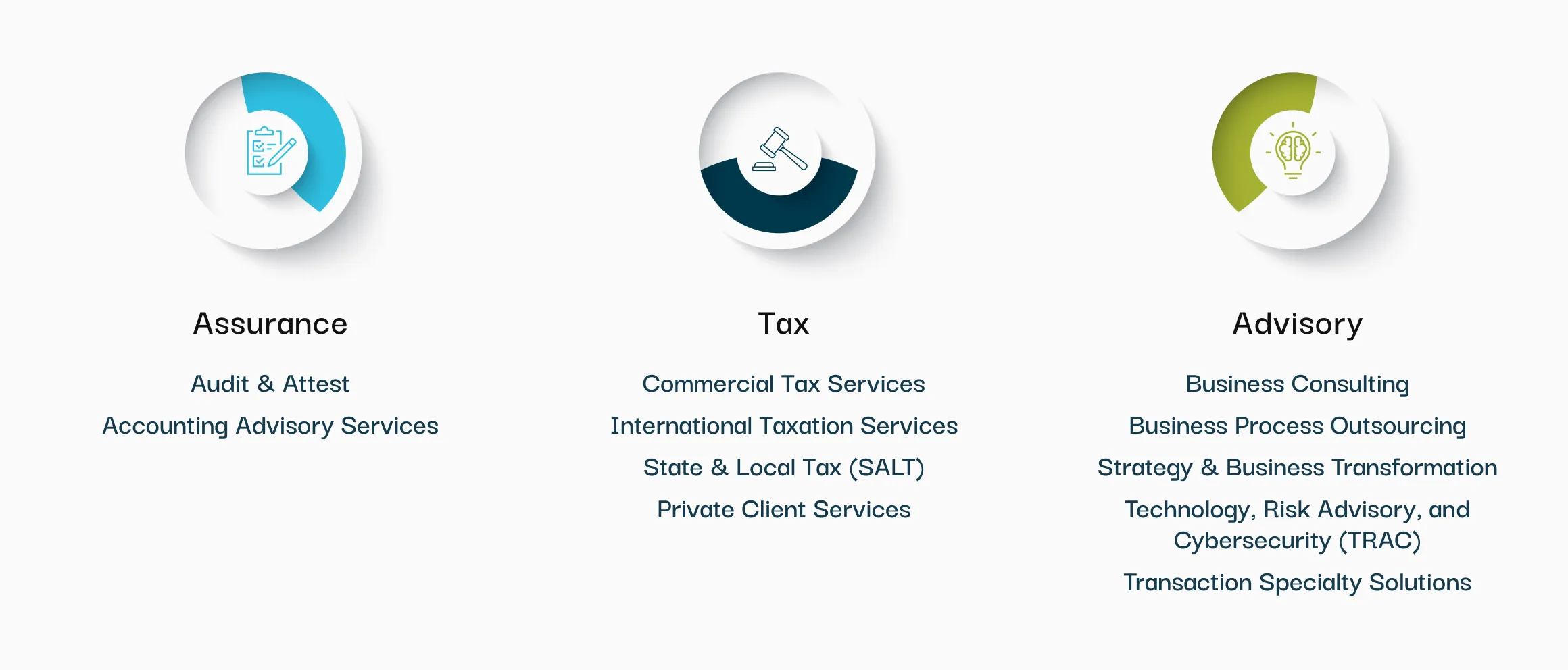

In addition to the attest and tax compliance services that we provide to our clients, our dedicated real estate professionals are available to advise on and provide additional services specific to the real estate industry, such as:

- Carried interest calculation and analysis

- 1031 advisory services

- REIT compliance

- Cost segregation analysis and energy efficiency consultation

- Foreign investor tax reporting and withholding

- Identification of federal, state, and local tax credits

- Opportunity zone benefit analysis

- Cash flow and profitability analysis

- Common area maintenance studies

- Review of rent escalations and other lease provisions

- Complex partnership tax concept consultation

- Transaction/deal structuring

- Fund structuring

- Effective investment and succession planning

- Acquisition due diligence

- Development of internal controls

- Assist in building internal/external teams

Real Estate Leader

View All SpecialistsReal Estate Insights & Resources

All InsightsContact Us Today

If you are a California Resident, please refer to our California Notice at Collection. If you have questions regarding our use of your personal data/information, please send an e-mail to privacy@citrincooperman.com.