February 10, 2025 - There is a reason so many real estate firms are outsourcing more of their operational functions, most notably, finance, accounting, and technology. These firms are discovering that outsourcing can reduce overhead costs and provide greater access to a variety of talents, thus increasing their agility and efficiency.

With that in mind, here are three major, time-consuming tasks that real estate firms can outsource to improve their efficiency, refocus on their core competencies, and gain an advantage.

Download the guide to outsourcing finance and accounting for real estate →

Task 1: Rote work, like bookkeeping, accounts receivable, and more

Real estate professionals know all too well the extensive transactional volume that comes with this line of work. They must deal with all the traditional functions — managing accounts payable and receivable, payroll, financial reporting, tax compliance, month-end closing, and so on. In addition to these conventional responsibilities, they must manage security deposits, reconcile tenant accounts, and track various types of income, from rental revenue to capital gains on property sales. Real estate firms also need to maintain detailed records for each property, including acquisition costs, improvement expenses, and depreciation schedules.

Dealing with all of these accurately is a difficult feat and requires a suite of qualified accountants. With the average bookkeeper and accountant salary being $63,956 and $85,904, respectively, it requires a significant investment to build out that finance team. Not to mention, there is currently an accountant shortage, making it even more difficult to find and retain those individuals.

One approach real estate firms can take is to outsource rote tasks, like bookkeeping, accounts receivable, forecasting, and more. An outsourcing provider can handle your routine bookkeeping and accounting needs and deliver standard financial reports, including balance sheets and profit and loss (P&L) statements, to help leaders understand the performance of individual properties or the overall portfolio.

Task 2: Full-service accounting

Beyond basic bookkeeping and day-to-day accounting tasks, there may be firm-specific needs that outsourcing can address. For example, an organization could need detailed financial analysis, cash flow projections, or budgeting and forecasting to better support their decisions. Another firm may need an industry specialist for certain situations, such as implementing or maximizing the use of a particular software, or a senior accountant to provide strategic financial guidance on how to automate a specific task within that software.

Whatever those needs, it is likely that outsourcing accounting can provide a team of professionals with expertise in all those specific tasks. They can tailor their services to exact requirements and needs, providing the right skills and bandwidth to solve back-office finance and accounting problems and to support internal teams.

Full-service outsourcing also ensures business leaders have the right financial insights to make truly informed decisions for their firms.

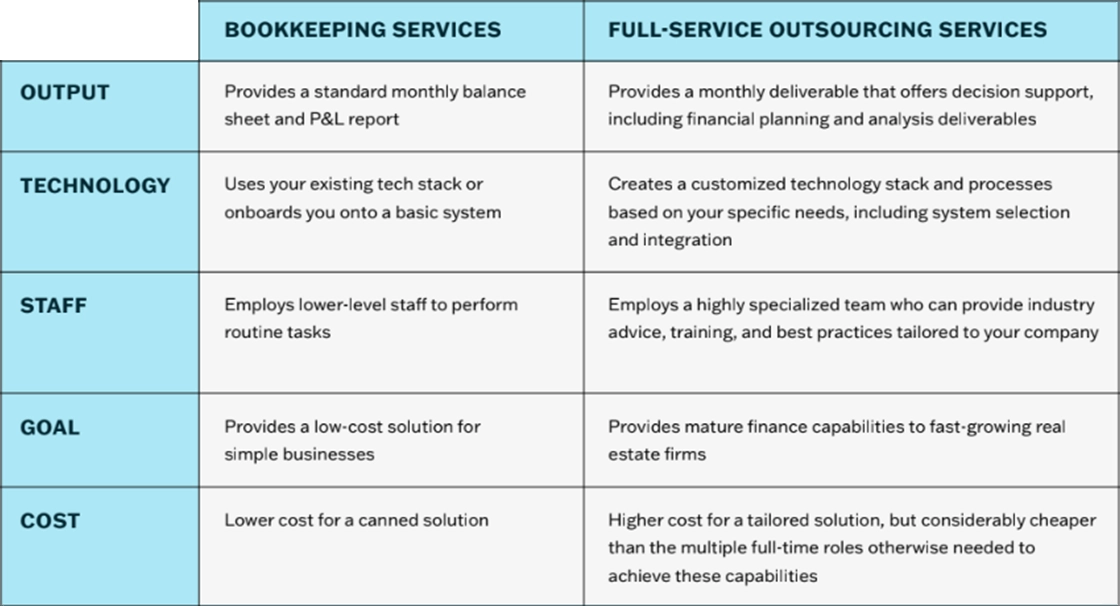

Some of the key differences between bookkeeping and full-service outsourcing, highlighted in Citrin Cooperman’s recent guide to outsourcing finance for real estate, include:

Task 3: ERP system audit and management

An enterprise resource planning (ERP) system is supposed to manage entire real estate operations, from accounting and property management to leasing and construction. It should allow businesses to automate some of their day-to-day tasks and provide real-time access to key metrics for better decision making. For instance, a dashboard that measures net operating income (NOI) and its leading indicators, like falling realizations, can help managers direct their teams.

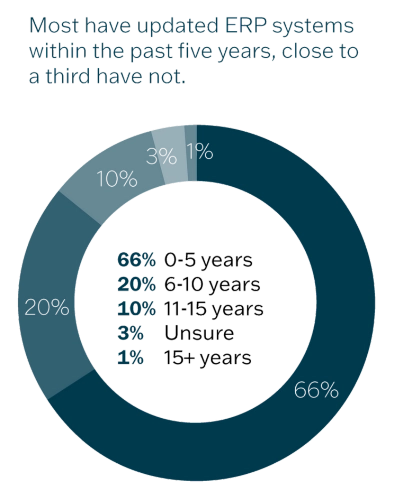

However, properly configured and maintained ERP systems are rare according to Citrin Cooperman’s Private Company Performance Report. Almost a third of ERPs are not up to date — 30% of companies have not updated their system within the last five years, with 10% of companies going more than 10 years since their last update.

[Source: Citrin Cooperman Private Company Performance Report]

This can lead to inefficiencies, like the system not being interoperable with the organization’s modern technology stack, data inaccuracies, and missed opportunities.

For ERP systems that are not performing as expected or if it is not known when the system was last updated, there are third parties that can be hired to conduct an audit. This will help identify any gaps or issues with the current system and determine what updates or changes are needed to ensure it is optimized for the firm's needs. These providers can deliver an objective assessment of the ERP system and recommend what can be done to improve it.

Outsourcing does not replace your in-house team; it enhances it

The goal of outsourcing is not to reduce headcount. In-house teams are necessary, and outsourcing can support them in taking on more strategic roles and free them up to perform other management tasks. When Citrin Cooperman’s Business Process Outsourcing professionals handle rote and time-consuming bookkeeping tasks, add surge capacity where necessary, and provide real-time insights that can inform your decision making, you can focus on higher-value activities to run a more agile and efficient firm and move the company forward.

If you want to get started on outsourcing your tedious and repetitive tasks, please reach out to Ryan Moore and Deanna Rich.

Download the guide to outsourcing finance and accounting for real estate →