How Citrin Cooperman Can Help

The digital asset sector is transforming at an unprecedented pace, presenting businesses with a distinct set of challenges. Companies in this space must navigate complex requirements, from rigorous regulatory compliance and evolving tax rules to heightened standards for investor readiness and robust cybersecurity. In this environment, the risks — and opportunities — are higher than ever. Citrin Cooperman’s Digital Asset Industry Practice is here to help your organization confidently navigate this evolving landscape with responsive, specialized guidance tailored to your business’ needs.

Investor Readiness and Financial Integrity

Start-up and growth-stage companies often struggle to meet the expectations of potential investors.

Common issues include:

- Incomplete or inaccurate financial statements

- Internal control deficiencies

- Poor record-keeping

- Technology and cybersecurity vulnerabilities

- Lack of audited financial statements

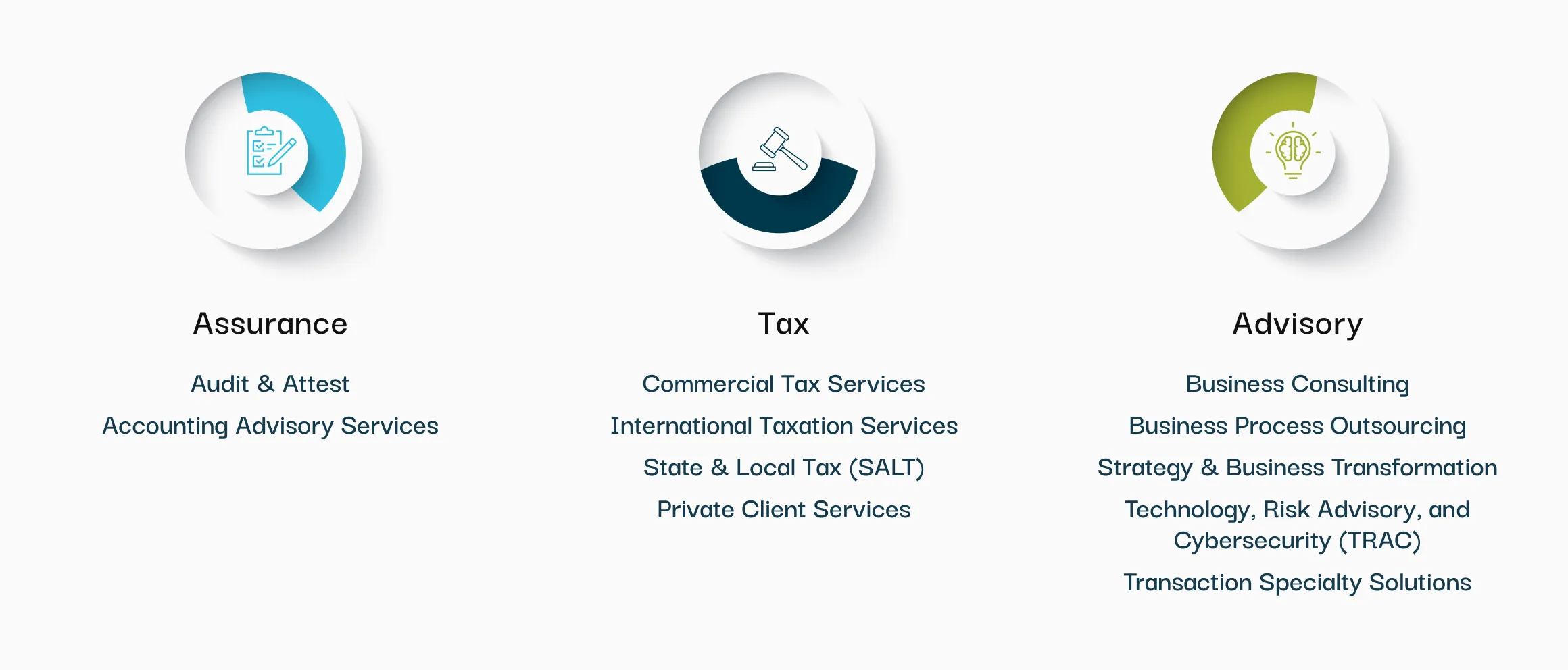

Our team works alongside businesses to tackle these challenges and prepares you to engage with investors. Backed by robust expertise in accounting, tax, advisory, and technology — and supported by our Digital Asset Committee of over 30 professionals — we deliver comprehensive solutions designed to meet your organization’s unique needs.

Comprehensive Services for Digital Asset Businesses

We take a team-based approach to support all aspects of your digital asset operations, including:

- Technical Accounting and Financial Reporting

- Tax Compliance and Planning

- Strategic Business Planning

- Entity Structuring for Funds and Ventures

- Cybersecurity and Technology Advisory

- Audit and Assurance Services

Whether you are launching a new platform, managing a tokenized ecosystem, or scaling your operations, Citrin Cooperman has the professionals and experience to help you succeed.

Specialty Services

In addition to our core assurance, tax, and advisory services, we also offer a custom suite of services focused on the industry. These services include:

Digital Asset Leader

View All SpecialistsDigital Asset Insights & Resources

All InsightsContact Us Today

If you are a California Resident, please refer to our California Notice at Collection. If you have questions regarding our use of your personal data/information, please send an e-mail to privacy@citrincooperman.com.