DOJ Releases Record-Breaking False Claims Act Results

The Department of Justice (DOJ) recently announced key highlights and results of False Claims Act (FCA) activity for fiscal year 2025. Accompanying the announcement, the DOJ also provided a Fact Sheet with representative cases as well as a statistics sheet.

Key Takeaways:

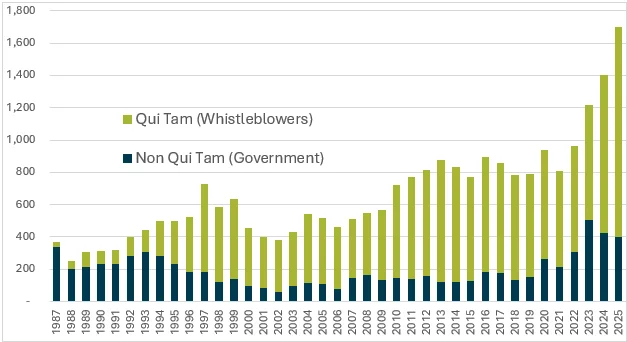

- Record-Breaking Whistleblowers: For a second consecutive year, the DOJ reported record-breaking whistleblower filings with 1,297 new FCA cases in FY25, a 32% increase from the prior record of 980 cases set in FY24.

- Record-Breaking Recoveries: FCA settlements and judgements exceeded $6.8 billion in FY25 — the highest annual total in the history of the statute. Of this amount, over $5.7 billion (or 83%) was related to matters that involved the healthcare industry.

- Tariffs and Customs: The DOJ continued its ramp up of tariff and customs cases, led by the recently formed cross-agency called the Trade Fraud Task Force. In December 2025, the DOJ announced the largest customs fraud resolutions in FCA history, which included a $9.75 million whistleblower award. Tariff and customs enforcement continues to be a high priority for the DOJ’s civil and criminal divisions.

- Procurement, Loan, and Grant Fraud: The DOJ also highlighted continued pursuit of fraud matters involving the purchase and sale of goods and services by the government, violations of critical cybersecurity requirements in federal contracts and grants, and misuse of pandemic relief program funds.

- Incentives to Self-Disclose: The DOJ re-iterated its continued commitment to incentivize and reward companies and individuals that self-disclose misconduct, take effective remedial measures, and cooperate with government investigations. Such incentives include potentially reduced penalties or damage multiples, as highlighted by several settlements in FY25.

-

Whistleblowers Drive Overall FCA Activity: While the government can and does bring affirmative FCA actions on its own (non-qui tam actions), the majority of FCA actions stem from whistleblowers (qui tam actions). In FY25, the 1,297 new whistleblower cases represented 76% of total new FCA matters.

Source: DOJ Fraud Statistics, visual chart created by Citrin Cooperman

Source: DOJ Fraud Statistics, visual chart created by Citrin Cooperman

Whistleblower Overflow Expected in 2026

As we previewed here, federal whistleblower programs have proliferated, and FCA is but one of several mechanisms through which whistleblowers can come forward. The Customs and Border Protection’s (CBP) e-Allegations program, for example, allows whistleblowers to report tariff fraud among other unlawful trade practices.

Notably, CBP’s e-Allegation program received far more whistleblower reports (1,746) in the first seven months of 2025 than the total FCA whistleblowers (1,297) for the entire FY25. More notably, as of January 2026, CBP has not yet released e-Allegation statistics for the five-month period August through December 2025 — indicating the pipeline of potential tariff and customs cases is incredibly overflowing.

How Citrin Cooperman Can Help

Citrin Cooperman’s Financial Investigations & Regulatory Enforcement Practice works with clients and their legal counsel in FCA matters, whistleblower investigations, self-disclosure and remediation, DOJ and other regulatory inquiries, litigation, and more. As part of the firm’s Forensics Services Practice, we specialize in forensic accounting, ‘big’ data analysis, and economic damages calculations. We help clients assess exposure, develop credible remediation plans, and present fact-based positions to regulators and courts. To learn more, contact Kevin Tanaka or Atul Chandra.Latest Articles

.webp)

Tech-Powered Talent Revolution: How Staffing Firms Can Use AI and Automation to Drive Growth

Read More

Gaining Spend Control by Connecting Procurement and Payables

Read More

Boosting Performance and Profitability: Staying Ahead of the Curve in the Asset Management Industry

Read More

.webp)

Stop Calling It a System Gap: The Process Problems Hiding Behind Software Customization Requests

Read More