The Present and Future State of Asset Management: Capital Raising

Our 2026 Asset Management Survey Report gathers the responses and insights from 300 asset management leaders across the United States for what is top of mind in the industry, including capital raising. Among our survey respondents, we see capital sources shifting from predominantly high-net-worth individuals to a balance between those individuals and institutional investors, like corporate and public pension funds or insurance companies. This shift brings added burdens for increased reporting and other concessions, like lower fees. While timelines for funding sit in the 7–12-month range, on average, funding terms are increasingly demanding, while anecdotally, the market is seeing even longer fundraising timelines.

Sources of Capital

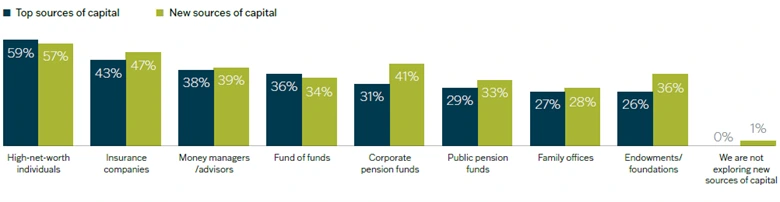

The asset management fundraising environment faces challenges and opportunities, both old and new. These include increased competition for capital and evolving investor preferences and demands. Amid this backdrop, our respondents identify their top present sources of capital as:

- High-Net-Worth Individuals: 59%

- Insurance Companies: 43%

- Money Managers: 38%

In our Emerging Managers Survey Report, the top three sources of capital for emerging managers captured similar responses as the respondents from this survey, with family offices (70%), wealthy individuals (64%), and fund of funds (43%). As they look for new sources of capital, it’s no surprise to see that a combination of corporate and public pension funds is identified as a top target (74% for the two combined), followed by high-net-worth individuals at 57%, and insurance companies at 47%.

These statistics are more than numbers – they shape capital sourcing strategy, help asset managers allocate marketing and relationship management resources effectively, and ensure they’re building the right products for the right investors.

“As firms mature and develop, their track records and their funding sources usually tend to shift. By the time firms are on their third, fourth, or fifth fund, they are more likely to obtain capital from more institutional sources such as pension funds,” states Alexander Reyes, partner and Financial Services Industry Practice leader.

Types of New Funds Offered

As fund leaders work to increase assets under management, create more value, and outperform competitors — all amid market volatility, shifting investor demands, increasing regulatory scrutiny, and rising operating costs — the most common new funds being brought to market are private equity funds (56%), venture capital funds (51%) and private credit (50%).

Leveraging Third Parties

In the search for capital, managers have long relied on third parties to bring expertise and access to sourcing capital in a highly competitive environment. For these and other reasons, it is not a surprise that nearly all respondents (96%) use third parties to help source capital. Our respondents most frequently use consultants (70%), placement agents (65%), and prime brokers (55%) in capital raising activities.

Engaging external partners is a standard industry practice. While the majority of survey respondents are more established managers, we would like to highlight the importance of emerging managers partnering with third parties. These partnerships can offer an introduction to established relationships with institutional and high-net-worth investors, can lend credibility to a manager’s fund and strategy, and can bring deep market insights, investor preferences, and regulatory awareness. This helps managers tailor their pitches, navigate complex sales cycles, and align with investor expectations. Those who fail to leverage these third-party relationships risk falling behind peers in fundraising reach and efficiency.

Fundraising Timelines

The process of building relationships, conducting due diligence, and landing on lead investors has always taken extensive time. Today’s market conditions and economic uncertainty make the process even harder and perhaps longer for some — especially emerging fund managers. According to PitchBook, the median time to close a round has nearly doubled over the past decade, from 7.4 months to 13 months. This is in line with our survey respondents: 60% say the work to launch a new fund is 7 - 12 months on average and 29% estimate the process to be over a year.

The survey findings are consistent with what we are hearing directly from investment managers. Not only is the fund-raising timeline lengthening, but emerging managers continue to face headwinds, while established managers have found it slightly less difficult to raise capital for successive funds.

Investor Demands and Concessions

As fundraisers build credibility, create momentum, and signal quality in their new funds, concessions and preferential terms continue to be common and essential to successful fundraising. Over half of respondents (54%) provide increased reporting as a concession for early and anchor investors. Half or more are making anchor or early investor concessions with a combination of a Limited Partner Advisory Committee (LPAC) memberships, co-investment opportunities, liquidity options and lower fees. Three in four respondents offer tiered fees tailored to early commitments and amounts invested.

Side Letters

Investors are demanding greater visibility into their investments, more direct participation in attractive opportunities, and increased flexibility in managing their capital. These preferences, expressed through the common practice of side letters, highlight a shifting landscape in the relationship between investors and asset management firms driven by regulatory changes and market dynamics.

Side letters continue to have risks and rewards, requiring careful management and consideration. The types of additional rights or privileges being requested by investors range from increased reporting to lower fees. Leaders at asset management firms say that the top three requests by investors through side letters are increased reporting (60%), co-investment opportunities (56%), and liquidity options (53%).

- Increased Reporting: Driven by a desire for greater transparency, investors are seeking more detailed and frequent information about their investments through increased reporting.

- Co-Investment Opportunities: Offers the potential for higher returns, lower fees, and greater control over investment decisions. This is especially attractive to family offices and ultra-high-net-worth individuals.

- Liquidity Options: Investors are seeking more flexibility in accessing their capital, especially for long-term alternative investments. This can include negotiating more favorable redemption terms or the ability to transfer their stake in the fund.

Side letter requests and concessions for early or anchor investors continue to be prevalent. Allocators know that the fundraising environment is tough and do not hesitate to ask for concessions or preferential terms in order for managers to earn their capital.

Fee Trends

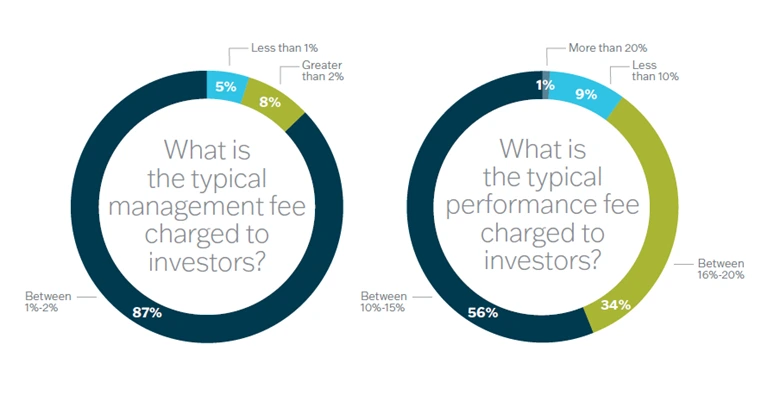

Management fees predominantly fall in the industry standard range of 1 to 2%, with nearly 9 in 10 (87%) confirming management fee charges within that range. Eight percent responded that management fees were greater than 2%.

Regarding performance fees, half of respondents (56%) say that typical performance fees are between 10 - 15%. One-third (34%) see performance fees in the 16 - 20% range.

Across the asset management industry, performance fees are declining for alternative investments due to investor pressure and the rise of low-cost products. At the same time, managers are using more innovative and complex performance-based fee structures to attract high-net-worth clients and justify costs for specialized strategies.

Citrin Cooperman’s 2026 Asset Management Survey Report

Latest Articles

The Present and Future State of Asset Management: Capital Raising

Read More

.webp)

SBA Increases Scrutiny of the 8(a) Business Development Program: What Government Contractors Need to Know

Read More

The Rise of the Real Estate Debt Fund

Read More

2026 Long Island Economic Survey

Read More