Uncharted No More: Deal Sources in the Independent Sponsor Sector

Our 2025 Independent Sponsor Report underscores how independent sponsors are redefining private equity by the way they source transactions. Once seen as fringe players, these sponsors now stand at the center of deal flow, leveraging a diverse range of channels to uncover opportunities. Drawing on insights from more than 170 professionals active in the sector, the Report highlights the evolving landscape of deal sources, from the dominance of business brokers to the rising influence of boutique and regional investment banks, and the nuanced role of company owners, operating executives, and research-driven outreach.

Deal Sources

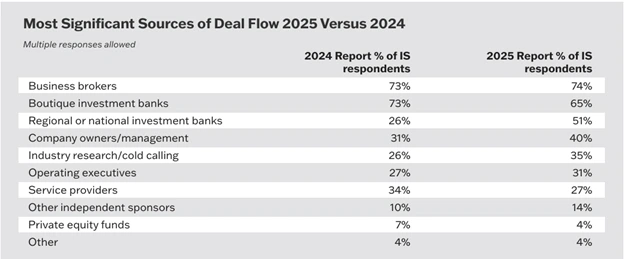

In this year’s Report, business brokers were the most popular deal source for our independent sponsor respondents, cited by 74%. Boutique investment banks were also a popular source, cited by 65% of respondents. Regional or national investment banks (cited by 51%), company owners/management (40%), industry research/cold calling (35%), and operating executives (31%) were the next most popular sources.

“I’m not surprised to see business brokers as the most popular deal source,” said Caroline Dallas, director, GEM. “Business brokers often view independent sponsor-led transactions as an area of real opportunity with a lot of value to be found once you look under the hood.

Typically, the larger the transaction, the more likely it is that a refined process already exists, and the less value there is to create.”

There have been some significant shifts in deal sources since last year’s Report. The most dramatic shift has been in the increased popularity of regional or national investment banks, cited by only 26% of respondents last year but 51% this year. “This may indicate independent sponsors are pursuing larger deals, and new independent sponsors are leveraging their investment banking relationships from prior institutional private equity (PE) experience,” said John Basile, senior account manager, Citrin Cooperman.

Among all IS survey respondents, 46% have closed deals from a broken auction process. Most of these are from firms 6 years old or older.

“In this environment, we are more likely to see sellers who reconsider selling or come out with valuations that are too high,” said Chelsea Celistan, principal, Avante Capital Partners. “It is very easy to get something under a LOI, but it can be hard to get it across the finish line when you are looking at the types of transactions common among independent sponsors – those with a bit of hair on them.”

Deals from broken auction processes can be a particularly good source of transactions for independent sponsors.

“At least a third of my deals or more are from broken processes,” stated Tarrus Richardson, founder and CEO of IMB Partners. “If a seller has gone through a broken process, they often get fatigued and become more realistic. They also become more focused on working with buyers they like and trust. That is when an independent sponsor can be a very good fit if they offer a hands-on, dedicated approach.”

Citrin Cooperman’s 2025 Independent Sponsor Report

Latest Article Cards

The Present and Future State of Asset Management: Capital Raising

Read More

.webp)

SBA Increases Scrutiny of the 8(a) Business Development Program: What Government Contractors Need to Know

Read More

The Rise of the Real Estate Debt Fund

Read More

2026 Long Island Economic Survey

Read More